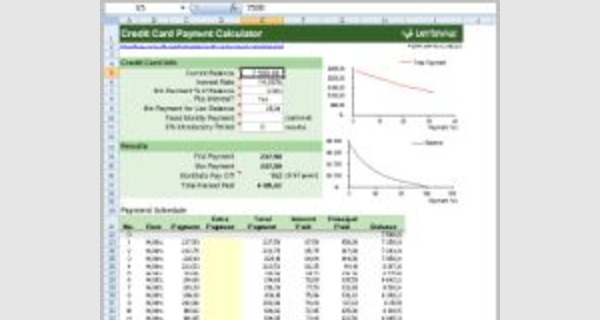

Excel template credit card payment calculator

Excel template credit card payment calculator

This article provides details of Excel template credit card payment calculator that you can download now.

Microsoft Excel software under a Windows environment is required to use this template

These Excel template credit card payment calculator work on all versions of Excel since 2007.

Examples of a ready-to-use spreadsheet: Download this table in Excel (.xls) format, and complete it with your specific information.

To be able to use these models correctly, you must first activate the macros at startup.

The file to download presents three templates Excel template credit card payment calculator

- Excel template credit card payment calculator

This Credit Card Payment Calculator estimates the time to pay off your card and the total interest based on making minimum payments. You can also choose to make fixed payments or extra payments to see how doing so may help you pay off the card faster.

- Excel template credit card payoff calculator

How long will it take to completely pay off the balance of a credit card at the current interest rate?

Enter your current balance and interest rate. Then, enter a monthly payment to calculate how many months it will take to pay off the credit card, or enter the payoff goal to calculate what your monthly payment must be to meet that goal.

The calculator assumes a constant interest rate, and it does not take into account any late fees, future charges, or cash advances.

- Advanced Excel template credit card payment calculator

The Temptation Of Credit Cards

Credit cards come bundled with various attractive features that are difficult to resist. Credit card companies understand that offering perks often leads to a paying customer – something you don't want to become.

That why you must practice the following 3 responsible credit card habits:

- Paying off the credit cards every month – Pay in full every month, and avoid the temptation to make minimum payments.

- Spending only what you can afford – If you can't pay for it with your checking account, you have no business paying for it with credit cards.

- Paying down existing debt – If you already have debt, use this debt snowball strategy to systematically improve your financial situation.

Choose A Payment Method

The Credit Card Payment Calculator allows you to choose one of two payment methods:

- Pay off your credit cards by using a fixed monthly payment you can afford. (Recommended)

- Pay off your credit cards by using the minimum payment percentage. (Bad idea)

Making minimum payments should be avoided if possible, as they typically keep you in debt longer than you want. By creating a budget, you can see exactly how much you can afford to pay toward your credit cards – often resulting in larger payments and less interest.

Credit cards offer unparalleled convenience, but that doesn't mean you have to pay interest to use them. Use the Credit Card Payment Calculator as a motivational tool, compelling you to avoid interest and years of indebtedness.

Credit Card Payment Calculator Terms & Definitions:

- Credit Card Balance Owed – The total outstanding balance you must pay including interest.

- Minimum Payment Percentage – The percentage or the fixed minimum amount that the credit card company requires you to pay each month.

- Fixed Payment – The amount you can pay on a consistent basis.

- Months Until Pay Off – How long it will take you to pay off a credit card.

- Total Interest Paid – The amount of interest you would pay over the course of your debt payoff plan.

- Total Principal Paid – The amount of your payments that went to principal.

- Annual Percentage Interest Rate (APR) – The amount of interest applied to your credit card purchases that were not paid in full each month.

- Interest – The amount paid for borrowing money.

- Principal – The original amount of money borrowed, not including interest. Be aware that when interest compounds, interest is added into principal.